november child tax credit schedule

November 18 2022. 3 Tax Credits Every Parent Should Know.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the deadline date.

. When does the Child Tax Credit arrive in November. Four payments have been sent so far. The maximum Child Tax Credit payment is 300 per month for each child under age 6 and 250 per month for each child ages 6 to 17.

That will be the sixth and final monthly payment this year. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. Includes related provincial and territorial programs.

If you got advance payments of the CTC in 2021 file a tax. Low-income families who are not getting payments and have not filed a tax return can still get one but they. Most of the mill Es noticia.

The taxpayers that have eligible children under the age of 6 receive 300 per child and 250 for every child between 6 and 18. Instead of calling it may be faster to check the. Married filing a joint return.

Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. To reconcile advance payments on your 2021 return. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

From then the schedule of payments will be as follows. Those who have already signed up will receive their payments after they are issued. 3000 per child 6-17 years old.

The IRS is scheduled to send the final payment in mid-December. Single or head of household or qualifying widow er 75000 or less. This change in the child tax credit doubled the credits value and expanded the age limit which was 17.

November 15 and December 15 are the last two days for monthly. 3600 per child under 6 years old. Goods and services tax harmonized sales tax GSTHST credit.

IR-2021-222 November 12 2021. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Get your advance payments total and number of qualifying children in your online account.

The opt-out date is on November 1 so if you think it may be. December 13 2022 Havent received your payment. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

A qualifying child must be at least four but less than 17 years old on December 31st of the tax year and must qualify for the federal child tax credit. By August 2 for the August. The Child Tax Credit CTC provides financial support to families to help raise their children.

Enter your information on Schedule 8812 Form. The next batch of child tax credit payments is scheduledfor December 15. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November. July August September and October with the next due in just under a week on November 15.

Child Tax Credit Payment Schedule for 2021. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit.

When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. 31 2021 so a 5-year. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. The IRS bases your childs eligibility on their age on Dec. Up to 300 dollars or 250 dollars depending on age of child.

Wait 5 working days from the payment date to contact us. However for some families the monthly payments arent needed. Up to 300 dollars or 250 dollars depending on age.

The monthly child tax credit payments which began in July are set to end in December. October 5 2022 Havent received. File a 2021 tax return by April 18 2022 to claim the CTC for 2021.

Users will need a.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Will There Be Another Check In April 2022 Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

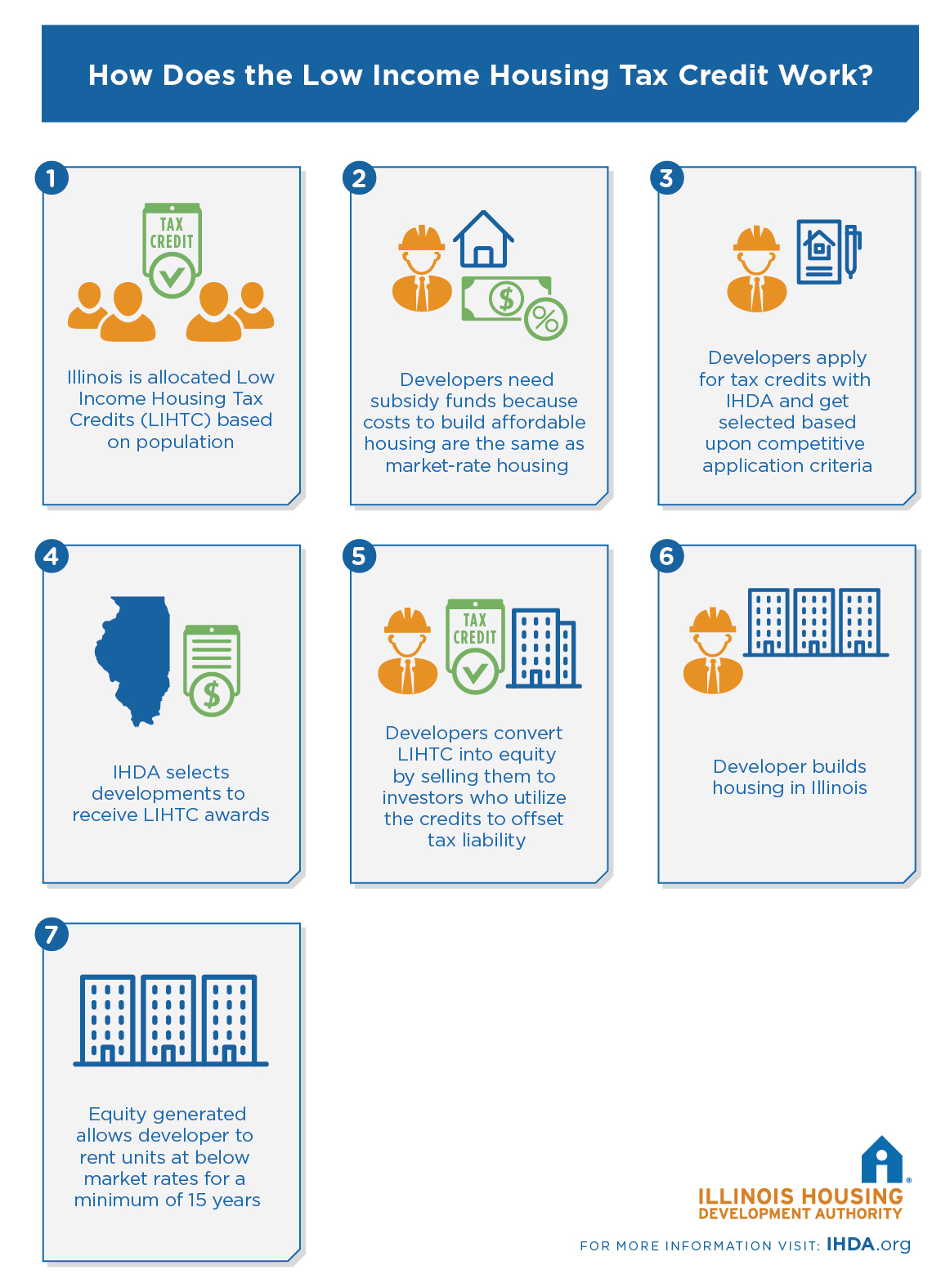

Low Income Housing Tax Credit Ihda

Childctc The Child Tax Credit The White House

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit Advanced Payment Option Tas

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

The Child Tax Credit Toolkit The White House

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2021 8 Things You Need To Know District Capital